主持人 / Moderator:

Jason Kravitt, Partner, Mayer Brown; Secretary of the Board, SFIG

讨论嘉宾 / Panelist:

Ann Rutledge, CEO, R & R Consulting (Left 1)

Sam Pilcer, Managing Director, Credit Agricole CIB’s Securitization Group (Left 2)

Howard Kaplan, Senior Partner, Deloitte; Board of Director, SFIG (Right 3)

Catherine McCarihan, Co-Chair of China Committee, SFIG (Right 2)

Sairah Burki, Director of ABS Policy, SFIG (Right 1)

编者按 / Synopsis

中国的资产证券化市场已经发展成为亚太地区最大的证券化市场,在不久的将来会成为全球第二大证券化市场。随着证券化规模的不断壮大,如何借鉴海外成熟的证券化市场发展经验及教训,是监管部门、从业人员需要面对的重要课题。

相比之下,金融危机后的美国已对其证券化市场展开了深刻的反思和制度变革,其中的经验和教训无疑为我们提供了宝贵的借鉴。美国证券化行业组织(SFIG,Structured Finance Industry Group)的董事会秘书、资深法律专家Jason Kravitt,在2015年中国资产证券化论坛年会上主持的“美国证券化监管改革对中国的借鉴(SFIG 组织)”的专题讨论,集结了来自美国证券化领域的各路精英,为我们全面剖析了美国证券化市场发展的问题和教训,其中包括:(1)如何警惕证券化市场的膨胀信号,监督保证市场的适度发展;(2)从风险评估的实时调控来反思可交易性的弊端;(3)如何协调发行人、投资者、债务人等主体之间利益的一致性,以此保证资产的信用质量;(4)监管如何增加金融机构承担风险的能力并限制其参与高风险活动以控制系统性风险的发生;(5)重视信息披露的透明度以及加强监管规则应对复杂化的结构产品的更新等等;(6)精简出10条美国证券化危机中得来的教训;(7)对中国资产证券化市场目前的发展阶段进行了相应的评价和建议。

这场讨论,可谓是有关证券化知识的一场饕餮盛宴。

Chinese Securitization Market has already became the biggest one in the Asia-Pacific region, and is estimated to become the second one among the world. With the ever-growing securitization scale, how to learn from the lessons and experience of mature oversea securitization market is an important topic to regulators and practitioners.

In comparison, America has done some serious reflection and market reform after the financial crisis which offers us valuable reference. In 2015 CSF Annual Conference, the panel discussion "The US Securitization Regulatory Reform: Lessons learned for the Chinese Markets (organized by SFIG)" which is moderated by Jason Kravitt, SFIG's secretary of board of directors, legal specialist brought professionals from different institutions together and analyzed the problems and lessons on the development of American securitization market thoroughly for us, which includes: (1)How to look out the signs that indicated securitization market may be overheating and ensure the market's development is in moderation; (2)Reflect the disadvantage of tradability from the perspective of risk evaluation; (3)How to make the alignment of interest among different subjects to ensure the credit quality of the assets; (4)How to control systemic risk by upgrading financial institutions' ability to handle risks and disincentivizing banks from engaging in certain high-risk activities; (5)Take care of transparency and innovative regulations updated with increased complexity of structured products; (6)Top 10 lessons learned from the securitization crisis in the U.S. ; (7) Put forward some proposals to the development of Chinese securitization market.

All in all, the seminar could be regarded as a great feast of securitization knowledge.

演讲实录/ Transcript of the speech

Jason Kravitt

大家好,我是Jason Kravitt。

Hello, welcome. My name is Jason Kravitt.

我不知道你们是否听说过芝加哥市的市长Rahm Emanuel,他曾经是奥巴马总统的总参谋长。在经济危机最严重的时候,他说:“我们不应该浪费一个好的经济危机。”这意味着,如果市场需要改革或者进行一些结构性的改变,那么危机就是一个好的时机,因为每一个人都愿意在第一时间做出改变。我想要以经济危机为背景,告诉大家我们在危机中学到了什么,以此让美国和中国的市场都可以充分利用这次的经验。幸运的是,我们有一个优秀的小组来探讨这些问题。首先,有请Sairah。

I don’t know if any of you have heard of the name of the mayor of Chicago, but he used to be President Obama’s Chief of Staff. His name is Rahm Emanuel. When the financial crisis was at its height, he was quoted, saying, “You should never waste a good financial crisis.” What that means is if the market needs reform or you need to make some structural changes, then a crisis is an opportunity to do it, because everybody will be willing to make the changes for the first time. We aim to use the crisis as a background and tell the audience what we’ve learned from it so that both our market and China’s can take advantage of that. We’re lucky to have a very distinguished panel to discuss those issues today. Let’s start with Sairah.

Sairah Burki

大家好,我是SFIG的Sairah Burki,我主要制定资产证券化的政策。

Hi I’m Sairah Burki with SFIG, where I run ABS policy.

Catherine McCarihan

我叫Catherine McCarihan,是美国银行和Merrill Lynch资产支持证券业务的国内顾问。我很荣幸能够成为SFIG中国市场委员会的联合主席。

My name is Catherine McCarihan, and I am internal counsel for the Asset Backed Securitization business of Bank of America and Merrill Lynch. I’m proud to be the co-chair of the Chinese Market Committee for SFIG.

Howard Kaplan

我叫Howard Kaplan,在德勤会计师事务所工作。我在这个行业已经有30年了。作为SFIG董事会的一员我感到很骄傲,我十分享受从事资产证券化业务。

I am Howard Kaplan, with Deloitte & Touche. I’ve been in this industry for 30 years. I’m proud to be a board member of SFIG and I enjoyed a very interesting career in securitization.

Sam Pilcer

我叫Sam Pilcer,在Crédit Agricole工作。从20世纪初期开始,我们公司就与中国有业务往来。公司分别在北京、上海和广州设立了分支机构,因此我们活跃在中国市场。同时,我们也在其他国家开展证券化业务,比如巴西、欧洲和美国。在最近的2、3年间,我对中国的证券化市场十分感兴趣。

I am Sam Pilcer with Crédit Agricole. Our business has had operations in China at the beginning of 20th century. We’ve got active branches in Beijing, Shanghai, and Guangzhou, so we’re very active in this country. We’ve started our ABS businesses in other countries as well, particularly in Brazil, as well as in Europe and the U.S. I’ve been interested in Chinese ABS market in last 2 or 3 years.

Ann Rutledge

我是Ann Rutledge。我于80、90年代在香港期货交易所工作,因此有幸参与了中国期货改革政策的研究。如今我很骄傲能够成为这个组织的一员,并从事拥有光明未来的证券化业务。

My name is Ann Rutledge. First of all, I would say I’m very lucky to have participated in China’s futures reform policy in the 80s and 90s by working in the Hong Kong futures exchange. I’m very proud to be among this distinguished group today and very happy to be part of the securitization industry. It has a bright future.

Jason Kravitt

现在进入提问环节。首先,Howard,从事后来看,你认为我们现在意识到的哪些新迹象揭示了当时证券化市场的过度膨胀?同时,在经历了这些迹象后,你认为为什么人们又重新选择了这条路径?也许你可以从中总结一些迹象,以此帮助人们预测市场是否陷入了危机。

Right, let’s start the questioning. First of all, with the benefit of hindsight, Howard, what signs new there that we now realize indicated our securitization market was overheating? And as we go through those signs, I’d like you to discuss why people started processes that they went through. Maybe you can distill things down to a few signs that people should look for in the future that generically indicate that the market may be in trouble.

Howard Kaplan

谢谢Jason。我想让每个人都思考下节制的概念。想象一下,如果生病了去看医生,医生询问你昨天做了些什么,你说你早餐喝了8杯咖啡,医生将会告诉你这样做是不利于健康的。1杯,2杯或者3杯咖啡都是可以的,但是8杯就不行了。接着,他问你昨晚上做了什么,你回答说喝了8杯红酒。医生会说这样也不行,也许1、2杯是可以的,但是8杯就不行了。现在,让我们想想一个机场。这个机场有两条20年前修建的跑道,当时飞机还很小,只能承载少量的乘客,大约每8分钟降落一次。现在飞机越来越大,承载了更多的人和设备,这将会花费大量的时间使这些人和设备上下飞机,同时飞机大约每4分钟降落一次,但是你仍然只拥有和以前同等规模的跑道。没有人想要花费晚上的时间在机场,因为第二天将会有更多的飞机、更多的人以及设备,并且晚点的飞机会影响第二天飞机的起飞。

Thank you very much, Jason. I’d like everybody to think for a moment about the concept of moderation. Imagine you go to your doctor because you feel ill, and he asks you what you did yesterday, and you said you drank 8 cups of coffee for breakfast. The doctor will tell you that’s not good. 1 cup, 2, maybe 3 is fine, but 8 cups not good. And he asks what you had yesterday evening, and you say 8 glasses of red wine. The doctor says that’s not good either, maybe 1 or 2 glasses, but 8 is not good. Now let’s think about the concept of an airport. It has 2 runways that were built 20 years ago, when the planes were smaller. Planes carried fewer people and landed maybe one every 8 minutes. Now planes are bigger and they carry more people and equipment. It takes longer to get these people and equipment on and off, and you still have the same size runway, and instead of every 8 minutes, you have a plane landing every 4 minutes. No one wants to spend the night at the airport either, because tomorrow there will be more flights, more people, and more equipment, and now delayed flights are slowing down the next day’s flow.

When I think about what was going on in the securitization industry in the 2000s, I wonder if we saw some of these signs coming around. Think about, for example, the offering document process. It got very complicated, and it started to take a very long time. Deals got more complicated—you had many different contributors and assets in the same deal. Consider also the concept of aggregation. Sometimes deals existed with 3 or 4 originators. We couldn’t always discern whether one was more sophisticated than the other. Sometimes the risks were hidden, because everyone was doing their best to try to aggregate a pool and describe all of what was included in that pool. That led to larger offering documents, which took more time to produce, which meant that dealers had to more carefully tailor deals to what investors need. So this meant it took more time to structure securities and more time to explain these structures. Eventually we just had too many deals happening at the same time that were too complicated to be quickly and efficiently described. Some deals were put off until the next month, but the next month, you had even more deals. For average transactions, documents were given out to the potential investors later and later in the month, and because of large supply of deals coming to the market and fear of missing these deals, investors had to make decisions very fast. We’ll hear a bit later about some of the changes that were brought into the market.

当我思考证券化行业在21世纪发生了什么的时候,我很好奇我们是否意识到了这些迹象。想一想,例如报价文件过程,它十分复杂,需要花长时间才能启动。交易变得愈发复杂,你就会在同一个交易中拥有更多不同的出资人和资产。再考虑一下集合的概念。有些交易有3到4个发起人,我们不能确定何者更加成熟。同时,每一个人都在尽全力地汇集资产池,且仅对池内资产的相关信息进行披露,因此有些时候风险被隐藏了。这就导致了将会花费更多的时间去形成交易文件,也意味着发行人不得不更加小心的针对投资者的需求来设计交易结构。因此,这意味着发行人将要花费更多的时间去设计证券和解释这些结构。最终,我们将在同一时间拥有太多的交易,并且这些交易是如此的复杂使得不能被快速且有效的描述。一些交易可能要推迟到下个月进行,但是下个月我们甚至有更多的交易。就交易的平均量来看,文件被越来越晚的分发至潜在的投资者。由于市场上大量的交易供给和恐于错失交易的意识,投资者不得不快速做决定。之后我将会谈论这些变化对市场造成的影响。

让我们把目光投向抵押市场。在住房抵押市场上,我们发现,随着市场的扩大,我们所称作的“可偿付产品”将会非常丰富。如果我们回想下近期的抵押市场,那么,最大形式的风险自留就是我们所称作的“预付款”。这是抵押物上的一个善意的保证金,如果债务人不愿意支付他们的抵押物,那么他们就不能收回预付款。当我们进入了21世纪并且开始接近信贷危机时,我们开始重新审视可偿付产品的泛滥。随着价格的持续可观,LTV不会再限于75%,越来越多的放贷方将愿意提供80%到90%的LTV,或者提供二次抵押贷款来帮助部分人住进房屋,接着住进更大的房屋。这些迹象指明一个事实,即市场是存在压力的。

Let’s look at the mortgage market. In the residential mortgage market, we found that as market expanded, you had this proliferation of what we called “affordability products.” If we remember back in the earlier days of the mortgage market, the greatest form of risk retention was what we called a "down payment". It was a good faith deposit on the mortgage, so that if at some point the borrower decided they didn’t want to pay their mortgage, they couldn’t get their down payment back. As we moved into the 2000s and started to approach the credit crisis we began to see the proliferation of affordability products. Instead of having a 75% LTV, with the concept that now prices will continue to appreciate, you’d have more and more lenders offering 80 and 90% LTVs, or offering second liens to assist someone to get into a home, and then it went to assisting to get into a larger home. Some of these signs pointed to the fact that maybe there was stress in the market.

从另一个角度,某些会计规则在公司没有销售完毕时也允许公司从交易中获利。虽然现在实现表外处理很困难,但也不会一直这么困难。在许多交易中,发行人不能或者选择不去售完所有的产品。他们继续持有部分产品是因为并没有遇到适当报价的买方,但同时他们也需要想办法在报表上显示这些资产。因此,他们必须选择一些会计假设来评估这些资产。这些假设永远不会被真实的放在紧绷的市场中进行检验,因此并非所有假设都被证明是正确的。有的公司会做循环交易来创收,以此满足投资者的期望。其中,一些公司是公众公司,并且有的公司最终因为其报告中的营利而增加了支撑其收入的股本。但是这些营利从未被紧绷的市场证实过。

If you look at the market from a different angle, certain accounting regulations allowed companies to take profits on their transactions even when they did not sell everything. Today it is very difficult to get off-balance sheet treatment, but it wasn’t always so difficult. In many transactions, you had sellers that could not or chose not to sell 100% of a transaction. The piece they held onto because they did not have a willing buyer at a price that they felt comfortable with. But yet, they had to report their assets on their books, so they had to come up with some ways to record that asset. They had to choose assumptions to value the asset. Those assumptions were never really put to test in a stressed market, so not all of those assumptions proved to be true. You also had companies that were in a cycle of doing transactions and reporting gains in order to meet the investors’ expectations. Some of these companies were public, and some ended up raising more equity capital because of the gains that they were reporting, which propped up their earnings. But those gains had never been tested in a stressed market.

所以,Jason,我认为迹象就在这里。如果节制,也许这些事情都不是一个问题,但这些都不是节制或适度的表现。大量的囊括所有资产类别的产品都涌入进了市场,我们可以发现当时采用了一些捷径,使得交易能够更快的进入市场以进行下一次的交易。事后来看,如果投资者没有足够的时间来评估交易的风险,那么投资者就会陷入困境。我们从那个时期的美国市场学到了很多关于不同资产类别的经验,我认为我们将会发现,这之中涉及的问题都能够被直接的解决,并且我坚信现在的市场是更加安全的。

So Jason, I think the signs were out there. In moderation, maybe none of those things would have been a problem, but this was not moderation. There was a tremendous supply of product coming into the market in almost all assets classes. We saw some shortcuts taken in order to get transactions into the market fast enough to clear for the next transactions. In hindsight, if you don’t give investors enough time to assess the risks of the transactions, you’ll probably get into trouble. We’ve learned a lot from the U.S. market during that period of time about many of the different asset classes. I think we’ll find that some of the matters were dealt with very directly, and I think we’re definitely in a safer market today.

Jason Kravitt

Sam, Howard向我们精彩的讲述了市场发生了什么。那么你认为如今中国市场处于从健康到危险的哪一个阶段呢?

Sam, Howard did a good job of describing in general terms what happened in the market. Where are we along the line from health to danger in Chinese market today?

Sam Pilcer

这是一个很好的引入。事实上,我很熟悉美国10年前泡沫化和过度化的ABS市场。在某种程度上,如今的中国ABS市场在某些方面同1985年或1986年的美国ABS市场相似。在中国ABS市场里,超过90%的都是CLO。在我看来,这是通过国内银行同业拆借市场将中国商业贷款风险进行联合的方式。同时,由于外国银行不能参与这个市场,外国银行并不是能够参与中国CLO市场并获取利益的机构。对中国信贷消费者而言,在这个市场上并不会面对美国抵押市场上过量的问题。

That’s actually a good lead in, and certainly I’m familiar with the frothiness and excesses of what happened in the U.S. ABS market about 10 years ago. To some extent, the Chinese ABS market today looks somewhat like what the U.S. ABS market looked like in about 1985 or 86. The Chinese market itself is over 90% CLOs. From what I can see, it’s a way of syndicating Chinese commercial lending risk through the interbank market, and as a non-Chinese bank not playing in that market, we’re not the sort of institution that’s going to have any sort of interest in that much exposure to the Chinese CLO market. Just in terms of Chinese consumer credit particulars, you don’t have the sort of issues that you had in the mortgage market that led to excesses in the U.S.

在中国的汽车市场上,2014年大约有8单汽车贷款证券化交易,这是我们在中国所能看到的披露程度。如今,中国的汽车贷款倾向于占70% LTV,意味着借款人只需在汽车上花费30%的费用,这在美国是前所未闻的。在美国,尽管汽车贷款证券化市场相比于其他资产的证券化没有破产的压力,大部分基本的汽车贷款仍覆盖汽车费用的100%到110%。即使中国的市场规模在逐渐变大,我并不认为中国的汽车贷款证券化市场会面临灾难,因为每年都应该有超过八单的证券化交易。

In the Chinese auto market, in 2014 there were about 8 Auto ABS deals and that’s the extent of exposure we’ve seen in China. Today’s Chinese auto loans tend to be done at about a 70% LTV on cars, which means the borrower is putting a 30% down payment on the car, and in the U.S. that’s just unheard of. Most prime auto financing in the U.S. tends to be at about 100 to 110 percent of the cost of the vehicle, and despite that the U.S. Auto ABS market saw none of the stress that other parts of the U.S. ABS markets saw in the crash. I don’t anticipate there’s going to be a big disaster in the Chinese Auto ABS market even though it is going to have to expand, because there should be more than 8 deals annually.

在我看来,迄今为止中国的RMBS市场不会发展至很大的规模。我并不是很了解中国的RMBS市场,只是感觉相较于美国的RMBS市场,中国市场更加的保守。正如Howard所言,美国市场已经发展至100%到110%的LTV。早在2000年的时候,美国的抵押市场投机于房产。尚且不论人们买更多他们所不能负担的房屋,或者二套房,或者取出房屋资产贷款,许多市场也煽动人们对房产的炒卖投机。当然,市场并没有健康的发展下去。另一个我在中国市场上没有发现,但是在美国及全球市场都有的是,中国市场上没有套利产品。在10多年前,美国和欧洲市场针对投资者发行了大量的套利产品,一方面使得基础证券对基础担保品而言过于先进,另一方面,套利产品十分过量。CDO、SIV等都是那个时代的市场特征。这些可以被称为“再证券化”,而在中国市场上并没有发现任何迹象。我认为这是在八年前破产后一些很好的改革。

From what I can see there doesn’t seem to be a Chinese RMBS market of any significant size just yet. I don’t know enough about the Chinese RMBS market to speak, except that I have a feeling it’s much more conservative than the U.S. RMBS market, which, as Howard indicated, ended up being 100 to 110% LTV market. Another aspect of the U.S. mortgage market in the early 2000s was that it really fed speculation on homes. Never mind the fact that people were buying more house than they could afford, or buying second homes, or taking out home equity loans, a lot of that market was just speculation on people flipping houses. Ultimately, of course, that didn’t end well. The one other thing that I don’t see at all in the Chinese market, which certainly happened in the U.S. market and globally, is that there’s no arbitrage product out there. A lot of what happened in the U.S. and Europe about 10 years ago was the issuance of massive amounts of arbitrage product to investors. So not only were the underlying securities too overadvanced in terms of underlying collateral, but then there was further arbitrage product being issued. If you’ve heard the term ABS CDOs, SIVs, that was all characteristic of those markets at that time. There doesn’t seem to be any evidence of that in the Chinese market. It’s typically referred to as "resecuritization", and I don’t see it here. I think it’s a good part of the reform that came with the crash 8 years ago, and that’s about the best I can say in summary.

Jason Kravitt

您的意思是中国市场上还没有出现美国市场曾发生过的风险,是吗?

The way I interpret your answer is at this point you don’t see the same risk in the Chinese market as we saw in the U.S.?

Sam Pilcer

远远没到那个程度。

It’s nowhere close to there.

Jason Kravitt

现在有请Ann从另一个视角进行分析。在市场产品的变革过程中,美国市场发生了什么改变呢?在很大程度上,众多的投资产品被视为交易产品,那这对市场意味着什么呢?同时,你能简单介绍下评级机构在融资过程中的角色吗?

Now let’s switch to Ann, to look at this in a different light. I’d like you to discuss what happened in the U.S. market in the evolution of the products that were produced by the market. Most investment products were in large part treated as trading products, so let’s discuss what that means to a market. And then could you also briefly go through what role you think the rating agencies played in the financial process.

Ann Rutledge

在“资产证券化的可交易性”的会议上以及众多的讨论中,包括对P2P结构能否具有可交易性的讨论,有大量的话题涉及到交易。有趣的是,目前的中国市场已经开始提出在美国市场后期才会遇到的问题。我认为可交易性的问题正是美国市场失败的地方。

So in picking up the theme of trading, there’s a lot of discussion in this conference about the tradability of ABS (there was in the last session), and also in the discussions involving P2P, there are conversations about whether P2P financing can become tradable. I think it’s interesting that the Chinese market is starting out asking questions that only developed in the later stages of the U.S. market, and I think the tradability question is really where our market broke down.

Sam提到了套利产品,但我不确定你们对这个概念是否熟悉。我知道你们了解CDO等,我准备从另一个角度介绍套利产品,并且打算以一件发生在2003年的事件作为开头。当时非典肆虐,但是非典在香港产生了一个非常有意思的现象。那里有两家教学医院,其中一家声称死亡率是4%。另一家称死亡率为10%,但事实上死亡人口是相同的。那么,区别在哪里呢?区别在于,声称4%的医院是以一种传统的公司融资的方式来看待风险,而声称10%的医院则使用的是我们称之为的“静态池方法”。在静态池中,我们是渐增的看待风险,而非平均风险。这就是资产证券化的基础,即使用一种允许真实套利的新数据来看待风险,这是十分有趣的。

Sam talked about arbitrage products, but I’m not sure if you’re familiar with the term. I know you know CDOs and so on. I’m going to talk about arbitrage products in a different way, and I’m going to start by talking about something that happened in 2003. We had SARS, and SARS in Hong Kong produced a very interesting scenario. There were two teaching hospitals, and one teaching hospital declared that the mortality rate was 4%. The other hospital said the rate was 10%, but they were talking about the same population. So what was the difference? The difference was that the “4%” people were using a traditional corporate finance way of looking at risk, and the “10%” people were using what we all know as a “static pool approach.” So in the static pool of risk, you look at risk cumulatively, not at average risk. This is the foundation of ABS, the way of looking at risk using new data that allows for genuine arbitrage, that makes it interesting.

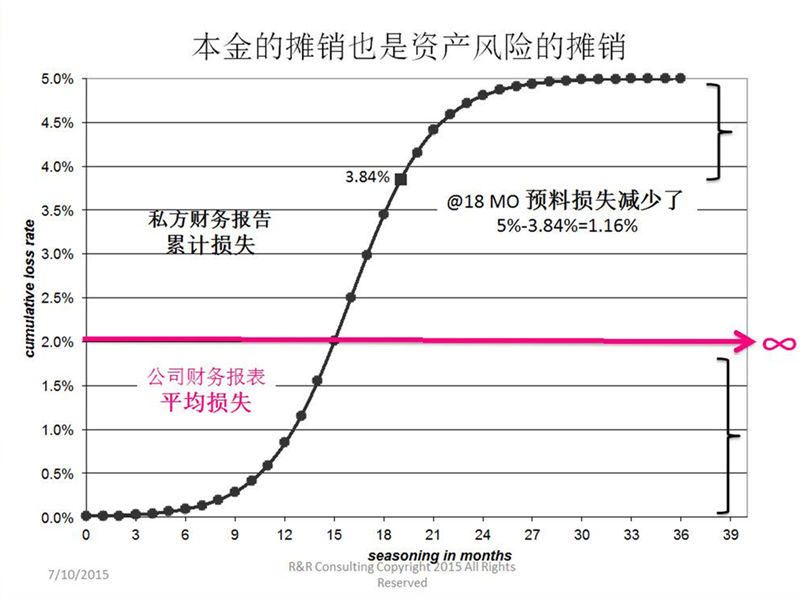

以下这幅图可以展示我的观点。

This picture illustrates what I’m talking about.

此处粉色线代表公司角度的风险,黑色线则代表静态池角度的风险——它是渐增的。我想指出的是,大多数人认为风险是图示5%的地方,实际上随着时间的推移,留存的风险是在不断下降的。因此,我们可以穿透的得出,对于结构完善的资产证券化而言,资产的易变性是在不断降低的,这个维度的分析不属于评级的部分。为了恰当的评估资产证券化的风险,你需要知道当下的风险而非最初的风险。这意味着,当评级机构做出评级时,他们进行了如图的假设。

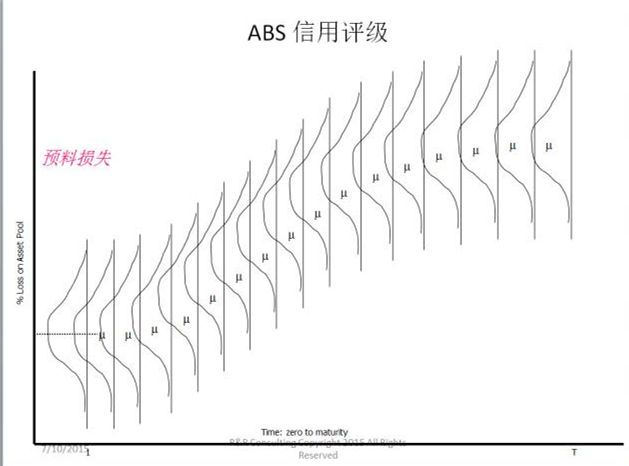

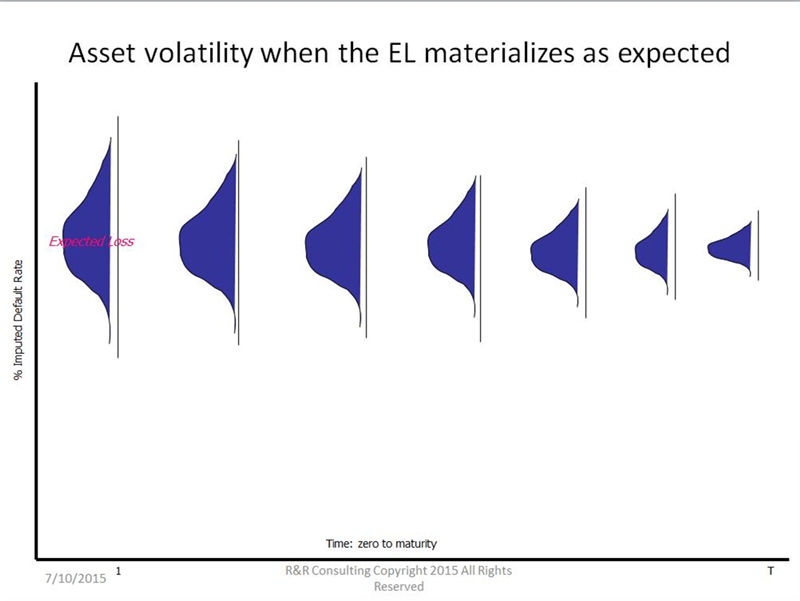

The pink line here represents the view of risk on a corporation. The black line is the view of risk on a static pool—it’s cumulative. I just want to point out that many of us believe that that risk, where the picture says 5%, but actually with the passage of time, the remaining risk is decreasing. So from that we can extrapolate to say that asset volatility on a well-structured ABS is decreasing, and that’s a dimension of the analysis that wasn’t part of the rating pattern. In order to properly assess the risk of an ABS you need to know what the current risk is, not the initial risk. What this means is that when rating agencies offer ratings, they’re using an assumption like this.

他们估计了逐增的损失,并利用了当下的不确定性来估计损失会继续发展。事实上,真正会发生的是我刚才所言的,如下图,

They project the cumulative loss, and they use the uncertainty of today and project it forward. In fact, what’s going to happen over time is just what I said—

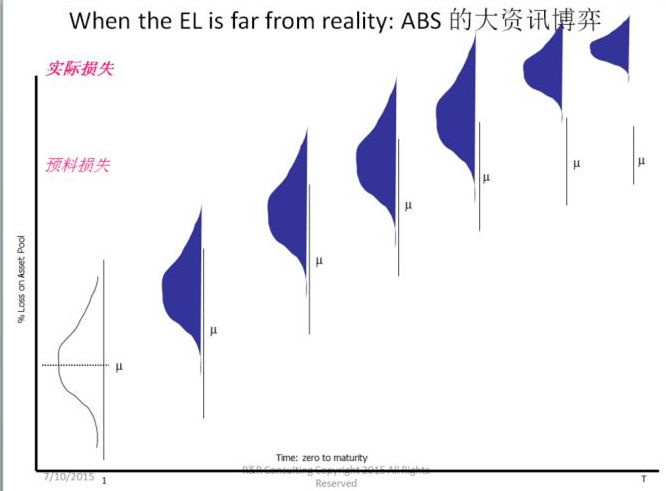

在一个结构完善的交易中,如果风险变成了最初所预计那样,评估就会变得越来越精确,风险会变得越来越小,同时防范风险所需要的资金也会变少。但是,如果系统不能与风险同步而是仅仅依赖于最初的估算,那这就会变成一场“赌博”。

In a well-structured deal, if the risk turns out to be what was projected to be in the beginning, then the estimation will get more and more precise, the remaining risk will get smaller and smaller, and the capital required to cushion that risk will also get smaller. But if you have a system that doesn’t keep track of risk and that relies on initial assumptions, then you have the opportunity to play a game.

这个“赌博”的目的是夸大报道资产池的质量,因为你不可能在一年、两年或几年内被察觉。现在,如果你是一个购买并持有的投资者,那么这种情况是不会持续的,在未来某一时刻你会认识到你的错误。你可以相信或者不相信可交易性是金融危机的驱动力,但我想要指出,总的来说,在结构金融市场中,如果你观察不同的市场版块,这里会有资金版块,例如ABS和RMBS等,接着有CDO、 RMBS CDO、CDO、SIVS等。所有的这些版块都基于评级而非经验数据来分析风险,仅有资金市场使用数据。根据现在发布的监管法规,我看到如今的监管偏向于管控行为、降低风险和促成市场的万无一失,但我甚至不确定我们现在所讨论的这些基础问题是否被监管计划考虑在内。

The game is to make exaggerated reports about the quality of the pool because you won’t be discovered for a year, two years, two and a half years out. Now, if you are a buy and hold investor, this kind of situation is unsustainable, and at some point in the future you’ll realize that you were wrong. Now you can believe me or not about tradability as the driver of the crisis, but what I’d like to point out is in the structured finance market overall, if you look at the different types of market sectors, you have the funding sector, the ABS/RMBS, etc. then we have CDOs, RMBS CDOs, CDOs squared. We have what Sam talked about- the SIVS, and all of these sectors analyze the risk based on rating, not based on empirical data. Only the funding market uses data. When I look at the regulations coming out today, I see that the regulations are geared towards controlling behavior, reducing risk, and making the market foolproof, but I’m not sure that the fundamental issue we’re talking about here is even in the regulatory plans.

Jason Kravitt

现在开始讨论我们提炼出来的问题。Sairah 和 Catherine将会谈及每一个问题,讨论解决问题的目标,再分析已经通过的解决问题的规则以及这些规则是否有效。现在开始讨论第一个问题:损害资产信用质量的失调动机。有请Sairah。

Now we’re going to look at the problems we’ve distilled. Both Sairah and Catherine will go through each problem, distill a goal to fix that problem, then look at the regulations that were passed to fix the problem and analyze whether they have been successful. So let’s start with problem #1: misalignment of incentives, which eroded the credit quality of the assets being originated. Sairah, why don’t you start?

Sairah Burki

谢谢!我认为Ann、Howard和Sam在某个程度上都谈论了这个问题,但是在金融危机中,一个明显的关键点是风险在发行人和投资者之间的失衡,尤其是在一些特定的资产类别中。基于这种失衡,考虑到发行人并不持有证券,他们很少有动机去确保贷款的质量。在Ann看来,这并不是一个买并持有的模式。在危机中及危机后,管理者认为一个运行良好且稳定的市场确实需要发行人和投资者之间一定程度上的风险对等。由美国六家主要的管理机构通过的信贷风险自留规则是在危机中产生的一个关键规则,它要求发行人在交易中至少自持5%的信贷风险。SFIG认为,这些要求促进了合理的担保以及风险的对等,但同时,这些规则中的一些要素仍对某些资产类别有负面影响。

Thank you. I think Ann, Howard and Sam all touched on this issue to certain extent, but one of the key issues that became very obvious during the crisis was the misalignment of risk between issuers and investors, particularly in certain asset classes. Due to this misalignment, originators and securitizers had little incentive to ensure that loans were of sufficient quality given that they weren’t holding them. To Ann’s point, it was not a buy-and-hold model. Regulators determined in the years during and following the crisis that a well-functioning stable market did require a certain level of risk alignment between securitizers and investors. One of the key regulations that came out of the crisis was the Credit Risk Retention rule passed in the U.S. by 6 of the major regulatory agencies, which would require securitizers to retain at least 5% of the credit risk of the deal. At SFIG we believe that these requirements generally do encourage sound underwriting and help align risk, but at the same time there are elements of the rules that we believe have had quite a negative impact on certain asset classes.

对于许多资产类别而言,例如信用卡和汽车贷款,这些规则并不是必备且最佳的,但是他们最终使得市场持续运转良好,并且提供了适当的风险对等。市场对于RMBS的作用可以一分为二。就Howard的早期观点而言,投资者担心在投资中表象并不充分。对于合格的贷款,或者就某些要求而言被视为合格的贷款,没有风险自留的要求。这种考量在于,对“合格”的定义十分宽泛。因此,有点讽刺的是,一些被认为是导致危机产生的资产类别会伴随着没有风险自持要求而结束。

For several asset classes, for Cards and Auto, for example, the rules are not necessarily optimal, but at the end of the day they do allow these markets to continue to function quite well and provide for appropriate risk alignment. For RMBS, we would say the market reaction was split. To Howard’s earlier point, investors are generally concerned that there still is not sufficient skin in the game. For qualified mortgages, or rather for mortgages that are deemed “qualified” according to certain requirements, no risk retention requirements exist. The concern is that the “qualified” designation is very broad; it’s not very stringent. You, therefore, have a scenario where the asset class that was deemed to be the cause of much of the crisis ended up with no risk retention requirements which is a little ironic.

其中一个风险自持要求失效的资产类别是CLO。尽管监管者对于这个问题开展了许多讨论,最后达成的规则是要求CLO的管理人持有5%的交易。问题在于,CLO的管理人并不是事实上的发起人,而是投资者,他们从投资组合中购买贷款。为了投资一个50000万美元的CLO,他们不得不持有2500万美元,同时大多数并没有对应的资产负债表来支撑风险自留的水平。基于风险自留要求在CLO中的不适宜,一个美国的交易组织针对证券交易委员会和联邦储备系统提起了诉讼。

The one asset class that risk retention requirements really don’t work for is CLOs. Despite a lot of conversations with the regulators, the final rule ended up requiring CLO managers to hold 5% of the deal. The problem here is that CLO managers are not actually the originators or securitizers, they are investors. They are buying loans for their portfolio. In order to invest in a $500 million CLO, they would have to hold $25 million, and most CLOs don’t have that kind of balance sheet to support that level of risk retention. The risk retention requirements for CLOs are so unfavorable that one of the U.S. trade groups has filed a lawsuit against the SEC and the Federal Reserve.

Jason Kravitt

那么,这属于A到F中的什么等级呢?

So just quickly, what’s the overall grade, from A to F?

Sairah Burki

除去CLO,我认为是B-。

Excluding CLOs, I’ll give them a B-.

Jason Kravitt

第二个问题,结构化产品与日俱增的复杂性和监管者无法同步实现创新。有请Catherine。

Problem #2: increased complexity of structured products and failure of regulators to innovate with such products work in parallel. Catherine.

Catherine McCarihan

随着产品复杂程度的增加,风险的不对等也在被强化,例如在美国,规则未能考虑到产品创新,使得市场的局部版块无法得到监管。美国金融管理改革中一个显著的成果是加强对市场上无监管的板块的管控,包括潜在的结构化产品,以缩小缺口并减少任何的监管套利。从积极的方面来看,这些规则引入了更好的控制、更强的责任制以及更大的透明度。如果问题再一次发生,他们也许能够更早的发现问题并潜在的减少发生系统性损失的风险。然而,因为考虑到先前的管理规则存在漏洞,使得当前涉及到金融改革的管理规则十分宽泛,有些时候是以“以一代全”的方式而不会考虑到每个证券化产品的细微差别。在一些实例中,你会发现规则倾向于更多的“传统”结构而不是重新包装风险的交易。

The misalignment of risk that Sairah just discussed is probably further exacerbated by the increase in complexity of products, which Howard also mentioned, such that the regulations at the time in the U.S. failed to account for product innovation and left certain segments of the market unregulated. As a result we see that one of the prevailing goals of U.S. financial regulatory reform has really been to increase oversight in unregulated parts of the market, including potentially structured products in order to close any gaps and reduce any regulatory arbitrage. On the positive side, these regulations introduce better controls, greater accountability, and greater transparency so that if problems arise again they may be detected earlier to potentially reduce the risk of systemic failure. However, because there are concerns that previous regulations included gaps, you’ll see that current regulations in connection with financial reform have been drafted so broadly, sometimes with a “one size fits all” approach that they don’t necessarily take into account difference nuances between securitization products. In some cases, you’ll see regulations favor more “plain vanilla” structures rather than transactions that repackage risk.

一个广泛的监管改革的例子是多徳-弗兰克衍生品法案第七章。这些规则的出台是为了管理在危机之前几乎没有被监管的柜台交易衍生品市场。然而,多徳-弗兰克衍生品法案第七章不仅规范这些CDS,同时也监管包括在证券化中广泛运用的简单利率和外汇对冲等所有交易。多徳-弗兰克衍生品法案第七章包括四个关键点。第一,交易商和交易的主要参与者需要在相关监管部门进行登记以便实现监督管理。第二,交易需要在票据交换所进行。票据交换所是涉入初始交易双方的第三方,通过“原始和变动保证金”的方式,即让交易双方提供充分流动的附属担保品以填补损失,保障了交易提供方和参与方的行为。第三,对于一些不在票据交换所进行的交易,有一些针对原始和变动保证金的建议以确保有充足的资金以填补损失。第四,对交叉换位进行广泛的报道,使得监管者能够在一个中心区域精确地了解交叉换位在市场中运行的状况。资产证券化的一个难点在于,交易的对手方通常是一个特殊目的载体的发行人,第七章的大部分条文并未涉及如何解决这类特殊目的工具的问题。

An example of broad sweeping regulatory reform has been the Title VII Dodd-Frank Derivatives regulations. These were promulgated primarily to oversee the over-the-counter derivatives market, which was virtually unregulated pre-crisis. However Title VII is sweeping in that it not only regulates these CDSs, but it also regulates all types of swaps including the more simple interest rate and currency hedges that are more commonly used in connection with securitizations. Title VII at a high level contains 4 basic initiatives. Number 1: it requires that swap dealers and major swap participants register with the appropriate regulatory authorities such that they are subject to regulatory oversight and supervision. Number 2: it requires that swaps be cleared through a clearinghouse, which is a third party that steps into the trade between the two original counterparties to guarantee both the performance of the swap provider and the swap counterparty by making them post sufficient liquid collateral to cover losses, which is called “initial and variation margin.” Number 3: that even for swaps that are not cleared through these clearinghouses, there are proposals for initial and variation margin to be posted in connection with these uncleared swaps to ensure there are sufficient funds to cover losses. Finally, Number 4: there is extensive reporting of swap position such that there is a central repository in which regulators can get a more accurate view of how these swap positions are performing in the market. The challenge for securitization is that often the swap counterparty is the issuer, which is a special purpose vehicle, and a lot of the Title 7 regulations may not have been designed to address special purpose vehicles.

除此以外,资产证券化结构的现金流通常被局限于来自于底层附属担保品的资金数量,使得对保证金要求的解释十分困难。我们有一个宽泛的会对利率和货币套换带来不确定影响的管理规则,这个规则通常被发行人和投资者合理使用以对冲利率和汇率风险。但是基于保证金要求,这个会变得过度的昂贵,资产证券化结构会变得不可行。另外,我认为这个规则倾向于传统结构,这也会导致出乎意料的后果。

Additionally, the cash flows of securitization structures are often limited to the amount of funds coming in from the underlying collateral such that it is very challenging to account for margin requirements. So here we have a broad sweeping regulation that may produce an unintended consequence in that interest rate and currency swaps that are used legitimately by issuers and investors to hedge interest rate and currency risk, but because of the margin requirements, this may become prohibitively expensive and the securitization structure may become unavailable. I believe the other, perhaps unintentional consequence may be that these regulations tend to favor plain vanilla structures.

Sairah Burki

谢谢Catherine。政策制定者关注的另一个地方是“高质量的资产证券化。”正如Anne所言,这些政策的动机并不在于解决危机中的基础问题。从背景资料来看,欧洲和巴塞尔的政策制定者使用了许多不同的字眼来提出建议,例如“简单、标准、透明、可比性”,这些都致力于同一件事,即构造一个能使局部资产证券化具有高质量的框架。这些资产证券化会在最终获得一个优先的监管待遇,包括在资金、流动性、投资允许度方面以及其他类似的待遇,而其他的证券化则不享受这样的待遇。问题是,在欧洲你可能会碰到市场不具有流动性的状况。政策制定者试图向市场中注入流动性,而资产证券化正是方式之一。当然,这些政策制定者非常清楚部分种类的资产证券化的污点会使得投资者回避ABS和MBS。他们相信,创造一个“高质量”的市场就能够激励投资者投资这些资产。

Thank you, Catherine. Another area that policy makers are focused on is what we’re calling “high quality securitization.” It speaks to the point Anne made earlier, that these initiatives are not necessarily tackling what the underlying issues were in the crisis. Just for some background, policy makers in Europe and in Basel have put forward a series of proposals using various different descriptors—simple, standard, transparent, comparable—all basically getting at the same thing, which is to try to design a framework that would designate certain securitizations as high quality. Those securitizations would ultimately receive preferential regulatory treatment, whether it be capital treatment, liquidity treatment, investment permissibility and the like, and all other securitizations would not. The problem is, in Europe, you have a situation where the market is not liquid. Policy makers are trying to inject liquidity into the market and use securitization as a way to do so. They are, of course, very aware that there is some stigma associated with some types of securitizations and that investors might be shying away from ABS and MBS. They believe that creating a slice of the market that’s labelled as “high quality” will incentivize investors to invest in those assets.

许多SFIG成员担心的问题是,将这种框架适用于美国将会潜在地破坏事先完整的体系。美国已经拥有一个具有流动性的市场,同时资产类别运作地好且具有高质量。但是,如果交易没有满足巴塞尔规则所规定的所有标准,本具有高质量和高流动性的交易会突然被视为不具有高质量,从而失去了流动性。这个问题引发了许多美国市场参与者的顾虑。

The concern that many SFIG members have on the U.S. side is that applying this type of framework to the U.S. would potentially break what isn’t broken. The U.S. already has a very liquid market with asset classes that are performing very well and are of high quality. But if they don’t happen to meet all the criteria that are laid out in Basel’s proposal, due sometimes to the fact that you have different structures in the U.S. vs Europe, deals that are actually very high quality and very liquid would suddenly be deemed “not high quality” and thereby lose their liquidity. This has caused a lot of concern among U.S. market participants.

Jason Kravitt

那么,问题二的解决方案适用什么等级呢?

So, what grade do we give the solutions to problem #2?

Catherine McCarihan

可能是B。

I would say maybe a B.

Jason Kravitt

我认为是C+或者C-。第三个问题,缺乏透明度可能会导致不适当的风险管理。有请Sairah。

I think it’s C+ or C-. Let’s go to problem #3: lack of transparency may have led to inappropriate risk management. Sairah is starting with this one.

Sairah Burki

缺乏透明度是危机中一个非常明显的大问题。从危机中产生的许多最重要的规则都是披露要求,例如由证券交易委员会通过的Regulation AB 修正案。

This was obviously a huge issue that became very obvious during the crisis—lack of transparency. Some of the most important regulations that came out of the crisis were the disclosure requirements, Regulation AB II that was passed by the SEC.

我们仍处于一个早期阶段,所以我不倾向于对这个赋予一个等级。证券交易委员会的目的是确保投资者能够在拥有足够多的信息的前提下作出一个知情决策。他们要求发行人对特定的资产类别提供一个贷款程度的公开。这个要求适用于汽车贷款证券化、CMBS、RMBS和再证券化。在2016年以前,发行人不需要遵守负债程度的要求,因为这些要求是如此的宽泛。但是他们工作的如此努力以在过程和系统中获得一个全面的改变。另一件有趣且有一点不寻常的事情是,当我们拥有最终版的Reg AB修正案规则时,证券交易委员会使许多条文处于开放状态,例如在特定资产类别上适用负债程度的披露,包括学生贷款、设备和信用卡。另一个开放的条款是对144A私募市场适用公募方式的披露和报道要求。如果这个真的发生,将会是对资产证券化市场及其他防范适宜的重大改变。

We are still in the early stages, so, Jason, I won’t assign a grade to this one yet, but what the SEC is trying to do is ensure investors have enough information to make informed decisions at the end of the day. What they have decided and are requiring is that for certain asset classes, issuers will have to provide loan level disclosure. This will be required for Auto, CMBS, RMBS, and resecuritizations. Issuers won’t have to comply with the loan level requirements until 2016 because they are so sweeping. But they are working very diligently to make comprehensive changes to their processes and their systems. Another interesting thing—a bit of an unusual situation—is that while we have the final Reg AB II rules, the SEC has kept several proposals open, such as the application of loan level disclosures to certain additional asset classes, including student loans, equipment and card. The other interesting open item is the potential application of public style disclosure and reporting requirements to the private 144A markets. If that were to happen that would be a very significant change for the securitization market and something to watch out for.

最终,我们鼓励一种平衡,使得投资者能够获得足够的信息来作出知情决策,同时发行人不会面临成本负担或者隐私及竞争顾虑。供需任一方的减少都会影响实体经济的发展。

Ultimately, we’d encourage an appropriate balance where investors receive enough disclosure to make informed credit decisions but issuers don’t face a huge cost burden or privacy and competitiveness concerns. A reduction in either supply or demand would reduce funding to the real economy.

Jason Kravitt

现在进入问题四。市场参与者的互相关联导致了系统性风险,从而导致了全方位的金融危机。

Okay, now we’re going to problem 4. Interconnectedness in market participants created systemic risk that contributed to the overall financial crisis.

Catherine McCarihan

我们即将要讨论的第四个问题和最后的监管改革是美国监管者降低系统性风险的期望,通过确保在金融体系中承担重要角色的金融机构和银行实体能够(1)在未来金融或者经济紧张阶段,准备充分地承受或者吸收损失;(2)不参与由于危机导致的具有高风险的活动。为了确保银行实体能够准备充分,如同其他国家,美国吸收了例如巴塞尔协议III的国际指引。巴塞尔协议III有三个关键点:第一,协议改变了风险资本要求,使得银行需要持有更多的资金以对抗风险加权资产,更深入的保护银行的固有客户不承担银行在证券化产品上的损失。第二,协议引进了一个补充的杠杆比率,通过确保银行持有的资金没有过量的方式来作为风险资本要求的后备力量。第三,协议引进了一个全新的流动性覆盖率来确保银行拥有充分的流动性资产来满足客户的短期流动性需求。这个包括了资产证券化的披露和衍生品。在美国,银行必须持有一级资本来对抗表内资产。但是作为新杠杆比率的结果,银行现在也必须持有一级资本来对抗表外资产,包括对SPV信贷承诺的披露。第四,关于新的流动性覆盖率,银行需要持有相当高质量且具有流动性的资产,这些资产能够立即转换为现金来防备所有净现金流出,即在任一30天期间内流出的资金。同时,流动性比率还包括对于特殊目的载体的信贷承诺。以上三种事情的结合会导致银行持有更多的高质量资金来对抗资产证券化的披露,使得银行不得不重新考虑投资何种类型的资产证券化披露,和以何种价格提供何种证券化产品。

The fourth and final regulatory reform that we’re going to discuss, though obviously there are many more, is the desire of U.S. regulators to reduce systemic risk by ensuring that financial institutions and banking entities that play a significant role in the financial system 1) be adequately prepared to withstand or absorb losses during future periods of financial or economic stress, and 2) do not engage in activities that are perceived to be high risk as a result of the crisis. In terms of making sure that banking entities are prepared, the U.S., like many other nations, adopted international guidelines known as Basel III, which contains three major initiatives. 1) It changes the risk-based capital requirement such that banks have to hold more capital against their risk-weighted assets to further protect the bank’s depository customers from any losses the bank suffers on its securitized assets. 2) It introduces a new supplementary leverage ratio, which really acts as a backstop to the risk based capital requirements by ensuring that the capital the bank is holding is not overleveraged. 3) It brings a new liquidity coverage ratio to ensure that the bank has sufficient liquid assets to meet its clients’ short term liquidity needs. This includes securitization exposures and derivatives. U.S. banks have always had to hold tier 1 capital against their on-balance sheet assets, but as a result of the new leverage ratio, banks will now also have to hold tier 1 capital against their off-balance sheet assets, including securitization exposures from credit commitments to SPVs. Finally, with respect to the new liquidity coverage ratio, banks need to hold certain high quality, liquid assets that can be immediately converted into cash against all total net cash outflows, which are the funds that flow out of the bank within any 30-day period. The liquidity ratio would also include credit commitments to special purpose vehicles. The combination of these three things will cause banks to hold more capital and higher quality capital against their securitization exposures so that banks will truly have to reconsider what types of securitization exposures they’re willing to invest in, what securitization products they are willing to offer, and at what price.

Jason Kravitt

通过声称不能将某些资产作为高质量流动性资产,巴塞尔协议三确实降低了市场的流动性。我认为,为了一个比率,通过制定一个“X具有高质量而Y不具有”的规则,会使得X具有流动性而Y不具有流动性。

Basel III has actually decreased liquidity in the market by saying that you can’t use those securitized assets as “high quality liquid assets.” I think that by making a rule that says “X is high quality and Y isn’t,” for purposes of a ratio, you’ve made “X” liquid, and you’ve made “Y” unliqulid.

Catherine McCarihan

是这样的。

Yes.

Jason Kravitt

你有什么要补充的吗?

You want to add anything?

Catherine McCarihan

是的。另一个减少系统性风险的方法是限制银行参与高风险的活动。在美国,沃尔克规则被运用于解决这个问题。沃尔克规则背后的基本原理是将银行的投资活动从传统的商业活动中分离出来。有一些活动被认为对银行来说具有高风险,例如将使得银行提供更多的具有高风险的传统性服务(如发放贷款给消费者),这个规则会阻止银行参与。在更高的程度上,沃克尔规则禁止银行进行自营业务,同时禁止银行获得规则所定义为“全覆盖债券”的某种以获得私有财产或对冲基金的所有者权益。就资产证券化的影响而言,全覆盖债券和所有者权益被规定的如此宽泛,以至于即使资产证券化活动没有被限制,你也会看见在许多的美国资产证券化交易中,市场参与者不得不对如何确定沃尔克问题是否存在而进行深入的分析。在一些例子中,因为沃尔克规则不受既定的证券化披露规则所限制,如果任何遗留的资产证券化交易不与沃尔克规则一致,银行则需要放弃这些资产证券化交易。

Yes. The other aspect of trying to reduce systemic risk is by disincentivizing banks from engaging in certain high-risk activities. One regulation that addresses this is commonly referred to in the U.S. as the Volcker Rule. The rationale behind the Volcker Rule is really to separate the bank’s investment activities from the bank’s traditional commercial activities. There are certain activities considered to be high risk for the bank, and this rule prevents banks from engaging in these activities if it would put the bank’s ability to provide more traditional services, like giving credit or financing to its customers, at higher risk. At a high level, Volcker prevents banks from engaging in proprietary trading for its own account, and it also prohibits the bank from having certain ownership interests in what the rule defines as “covered funds,” which is really intended to capture private equity or hedge funds. In terms of the impact of securitization, covered fund and ownership interests have been drafted so broadly that although securitization activities were not intended to be prohibited, you’ll see that in a lot of U.S. securitization transactions, market participants have really had to do a deeper analysis of how to determine if a Volcker problem exists. In some instances, because the Volcker Rule does not grandfather in existing securitization exposures, if any legacy securitization transactions don’t comply with Volcker, banks need to divest themselves of these securitizations.

Jason Kravitt

因此,我们普遍的认为沃尔克规则是一个问题。你认为沃尔克规则是什么等级呢?

So I think we generally consider the Volcker Rule a problem. So what’s the grade on this?

Catherine McCarihan

C-。

C-

Jason Kravitt

因此,我们有一个B-, C+, 未完成等级和一个C-。我确信他们能够运转地更好。我想要提出10条从美国资产证券化危机中得到的教训。

So we have a B-, a C+, an incomplete, and a C- . I’m sure that they can do better. I’d like to give you, for a little amusement, a list of the top 10 lessons learned from the securitization crisis in the U.S.

1.There is no manner in which to save a transaction through structuring if credit underwriting is done poorly. This was a really major part of the securitization crisis—you think you can solve it through structuring, but you can’t solve bad assets through structuring.

2. 任何为了使过程运转地更加流畅的捷径都会反过来伤害采取捷径的当事方。

2.Any shortcuts taken to make the process go smoothly will almost always come back to hurt the party that took them.

3. 如果某些事好到令人难以置信,他们往往会一直这样好到难以置信。

3.If something is too good to be true, it’s almost always too good to be true.

4. 没有就是没有。如果这里没有一个实质交易,这里就是没有一个实质交易。

4.Nothing + Nothing * Nothing will always equal nothing. If there is nothing to a deal, no substance, there is no substance to the deal.

5. 在紧张时期,所有相关系数都会倾向于1.0。对你们中不喜欢用数字来理解问题的人来说,就是指在经济紧张的时期,所有的事情都是相互关联的。不论你认为这些市场多么不同或相距多么遥远,当每一件事都开始崩溃的时候,没有一个市场是安全的。

5.In times of stress, all correlations tend to move towards 1.0. Now what that means for those of you who are not mathematically inclined is that in times of financial stress, everything is correlated with everything else. No matter how different you think markets are, no matter how far apart you think they are, when everything starts to fall apart, no market is safe.

6和7. 发行人和投资者之间的利益一致是不够充分的。这是当我们制定规则时通常谈论到的事项,尤其是风险自留规则。同时,债务人对于未偿还债务的利益是必须保持与发行人和投资者一致的。同等重要的是,机构雇员的利益应当和他们的雇主一致。我第一个观点的意思是,如果基础资产之上的债务人在不偿还债务时没有惩罚或责任约束,那么这个交易便不能进行下去,因为这里存在利益失衡。一个最好的例子便是没有预付定金和无追索权的抵押贷款。任何人都可以离开那个抵押,因为这里没有一个利益的联盟。我第二个观点的意思是,如果你对雇员有补偿标准,这些标准应同时以雇员长期(包括短期)的表现为基础,不仅严格限制在数量,并且包括质量的衡量。如果一个雇员企图通过从事更多的交易来获得资金,不论这些交易最终的质量,那个雇员的利益将不再与雇主的利益保持一致。

6&7.Alignment of interest between issuers and investors is not enough. That’s usually what we talk about when we draft rules, the retention rule specifically. But interests of obligors on the underlying obligations must have their interest aligned with issuers and investors. Equally importantly, the interests of employees of officers of institutions must have their interests aligned with those of their employers. What I mean by the first point is if the obligors on the underlying assets don’t suffer in some way, if they don’t pay, then the transaction isn’t going to work because there’s a misalignment of interest. The best example of that is a mortgage where there’s no down payment and is non-recourse. Anybody can walk away from that mortgage; there is no alignment of interest. What I mean by the second point is that when you have compensation formulas for employees, they should be based on what you’ve done in the long term (including the short term) and not based strictly on volume but also on quality. If an employee is going to make a lot of money just by entering into a lot of deals, whether they turn out to be good quality or bad, then that person’s interests is no longer aligned with those of the employer.

8.如果发行的主要目的是创造一个可交易的资产而不是一个可投资的资产,那么物质的诱惑会带来严重的后果。

8.When the primary goal of issuance is to make a tradable asset instead of making an investment asset, the temptation for substance to suffer is great.

9.不要忽视律师和会计师的意见,或者给他们施加压力来降低标准。

9.Don’t ignore the advice of your lawyers and accountants or put them under pressure to cut corners.

10.每一个危机都是不同的。不要过多的回望过去而看不到将要发生的危机。这次的小组讨论会都在回顾过去,但是你应当总是想到新的危机将会不同

10.Every crisis is different. Don’t look back at the last one so much that you don’t see the next one coming. This whole panel has been looking back, but you always have to be thinking about how the next one could be different.

我想要增加最后一条规则:当模型不真实时的设想。你被你的模型和假设所限制,但是他们从不反应一个真实的世界。尽管一个模型对于资产证券化来说十分的重要,但它仅仅告诉你需要回答什么问题,而永远不会告诉你问题的答案。

I realized I have a final favorite rule that I’d like to add: The assumptions when you model are not reality. You get mesmerized by your models and your assumptions, but they never reflect the real world. While a model is very important to securitization, it only tells you what questions to ask, and it never tells you the answers to those questions.

这就是我们在危机中学到的经验,希望能对你们在未来的市场中有所帮助。谢谢你们!

So that’s what we learned from the crisis, and I hope it’s going to be helpful to you in putting together future markets. Thank you for your interest.